Financial review for current quarter and financial year to date

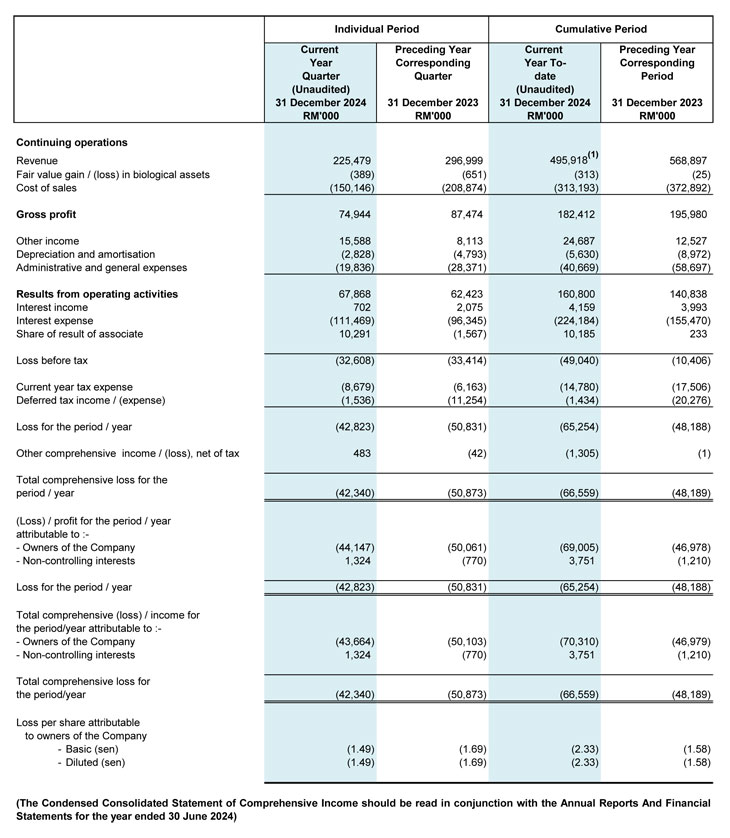

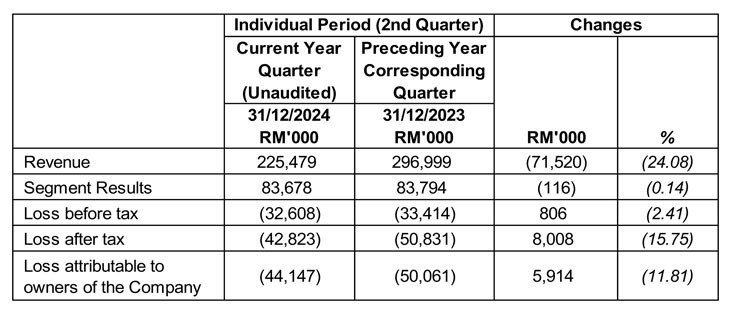

Current quarter ("2Q 2025") against preceding year corresponding quarter ("2Q 2024")

For the 2Q 2025, the Group reported a revenue of RM225.479 million and a loss before tax of RM32.608 million as compared to the revenue of RM296.999 million and a loss before tax of RM33.414 million reported in the 2Q 2024.

The performance of the respective operating business segments for the 2Q 2025 under review as compared to the 2Q 2024 is analysed as follow:

Construction operations

The construction segment reported a lower revenue of RM100.041 million for 2Q 2025, compared to RM184.929 million in 2Q 2024. The decline in revenue is primarily due to the completion of the Setiawangsa-Pantai Expressway ("SPE") project in the financial year ending 30 June 2024. As a result, the revenue for the current quarter is mainly from the ongoing Rapid Transit System Link ("RTS Link") project, which is progressing well and remains on schedule. In line with the lower revenue, the segment's profit decreased from RM30.370 million in 2Q 2024 to RM16.844 million in 2Q 2025.

Property development

The property development segment reported a lower revenue of RM7.761 million for the current quarter, compared to RM9.465 million in the corresponding quarter of the previous year. Similarly, the segment's profit declined from RM2.344 million in 2Q 2024 to RM0.248 million in 2Q 2025. This decrease is mainly due to fewer sales of the remaining units in EkoCheras during the current quarter. With limited units available for sale, the Group launched a new development, EkoTitiwangsa, in February 2025, with the goal of driving improved performance in the property development segment.

Toll operations

The toll operations segment reported higher revenue of RM73.699 million and a segment profit of RM58.869 million in 2Q 2025, compared to RM59.702 million in revenue and RM47.389 million in profit in 2Q 2024, reflecting an increase of approximately 23.44% in revenue. The higher revenue for the current quarter is mainly due to the increase in toll collections following the full opening of the new SPE Highway on 3 November 2023, which was not fully operational during the corresponding quarter of the previous year.

Plantation

For the current quarter 2Q 2025, the plantation segment registered a higher revenue of RM32.397 million and a segment result of a profit of RM10.777 million as compared with revenue of RM30.286 million and segment result of a profit of RM7.204 million in the preceding year corresponding quarter. The increase in revenue and earnings were mainly attributed to the improve in the average selling prices for the crude palm oil and fresh fruit bunches.

Food and Beverages

The F&B division reported a decrease in revenue to RM0.497 million for 2Q 2025, compared to RM2.650 million in the corresponding quarter of the previous year. The decline in revenue was primarily due to the scaling down of the F&B segment, with most outlets gradually closing. However, the reduction in operating costs helped mitigate the losses, which decreased from RM1.561 million in 2Q 2024 to RM0.281 million in 2Q 2025.

Property Investment and others

The property investment segment's revenue for the current quarter has increased to RM11.084 million in 2Q 2025, up from RM9.967 million in 2Q 2024. Similarly, the segment's profit has risen from RM1.796 million in 2Q 2024 to RM2.069 million in 2Q 2025. This growth is mainly attributed to the higher occupancy rate of the hotel, which has shown consistent growth and improvement since its opening in March 2023.

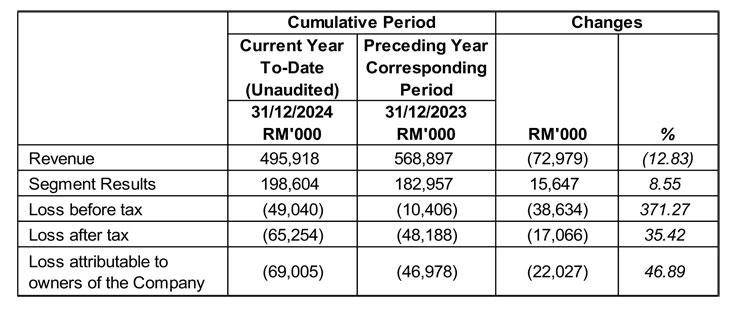

Current year to date ("YTD 2025") against preceding year corresponding period ("YTD 2024")

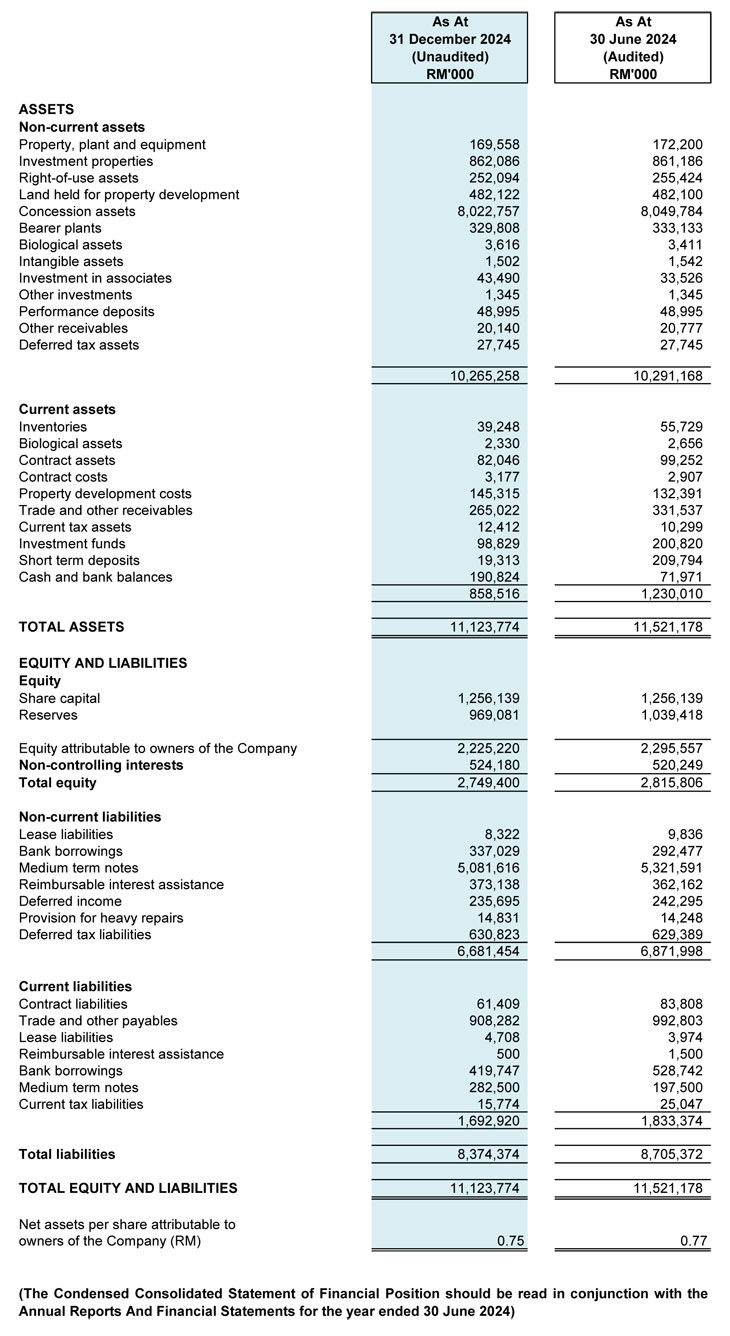

For the YTD 2025, the Group reported a revenue of RM 495.918 million and a loss before tax of RM 49.040 million, compared to a revenue of RM568.897 million and a loss before tax of RM10.406 million in YTD 2024. The increase in loss before tax for YTD 2025 primarily due to several factors. Firstly, since the full opening of SPE Highway in November 2023, the financing costs for the highway can no longer be capitalised in the financial statements. As a result, the Group's financing costs have risen from RM155.470 million in YTD 2024 to RM224.184 million in the current year to date.

Additionally, the Group has yet to receive the anticipated disbursement for the toll compensation related to the year 2023 toll rate hike deferral, which is estimated at RM64.318 million for Duke 1 & 2. Furthermore, the scheduled toll rate increase for Duke 1 & 2, due on 1 January 2024 has not been recognized.

As for SPE Highway, the Group is expecting some compensation from the government arising from the delays in project completion due to changes in alignment and interfacing issues with other government projects on site.

These factors have significantly impacted the Group's financial results for the current year to date.

The performance of the respective operating business segments for the YTD 2025 under review as compared to the YTD 2024 is analysed as follows :

Construction operations

The construction sector recorded a revenue of RM170.112 million and a segment profit of RM43.178 million for YTD 2025, compared to RM350.188 million in revenue and RM75.977 million in segment profit for YTD 2024. The decline in both revenue and segment profit is primarily due to the previous year's revenue being driven by the SPE Highway and RTS projects. With the completion of the SPE Highway last year, the current period's performance is now solely driven by the RTS project.

Property development

The property development segment for the YTD 2025 reported a higher revenue of RM96.446 million as compared to preceding year corresponding period of RM15.354 million. Similarly, the segment's result has increased from a profit of RM2.826 million in YTD 2024 to a profit of RM21.258 million in YTD 2025.

This improvement is primarily attributed to the two separate Sale and Purchase Agreements ("SPA") dated 22 February 2024 entered into by a subsidiary of the Company, namely Ekovest Properties Sdn Bhd ("EPSB") with Airman Sdn Bhd ("Airman) for the disposal of thirteen (13) parcels of land, as well as the second SPAs dated 29 July 2024 entered into by EPSB and Airman for the disposal of three (3) parcels of land. These SPAs have become unconditional, with a total revenue of RM75.181 million recognised in YTD 2025.

Toll operations

The toll operations sector saw a revenue increase, reaching RM147.318 million in YTD 2025, up from RM116.192 million in YTD 2024. Additionally, the sector reported a higher segment profit of RM121.711 million in YTD 2025, a rise from RM93.458 million in YTD 2024. This 26.79% growth was mainly driven by higher toll collections following the opening of the new SPE Highway on 3 November 2023. The continued increase in traffic on the newly opened SPE Highway has contributed to a stronger revenue performance in YTD 2025 compared to the same period last year.

Plantation

The plantation sector registered a lower revenue of RM58.080 million and a segment results of RM18.159 million in YTD 2025 as compared with the revenue of RM62.025 million and a segment results of RM13.647 million in YTD 2024.

The decrease in revenue was principally due to lower sales contribution for the offtake of downstream durian products. The earnings margin on the durian related businesses was also relatively weaker due to softer offtake rate by offshore customers. However this was mitigated by the improved average selling price of FFB as compared to the previous year corresponding period.

Food and Beverages

The F&B division recorded a decline in revenue to RM1.041 million for YTD 2025, compared to RM5.294 million in the same period last year. This drop in revenue is mainly due to the scaling down of the F&B segment, with more outlets gradually closing compared to the previous year. However, the loss has decreased from RM2.915 million to RM0.620 million.

Property Investment and others

The property investment segment's revenue increased from RM19.844 million in YTD 2024 to RM22.921 million in YTD 2025, primarily driven by a higher tenancy occupancy rate at EkoCheras Shopping Mall compared to the previous year. Additionally, the improved occupancy rate of the hotel also contributed to both the segment's revenue and segment result

The Board remains optimistic about the future growth of each of the Group's business segments and is confident that these segments will contribute positively to the Group's performance for the upcoming financial year ending 30 June 2025.

The Group has also seen a steady increase in toll revenue for Duke Phase-1 and Phase-2 following the lifting of the MCO in October 2021, along with the full opening of the SPE on 3 November 2023. This will further enhance toll collection revenue in this operating segment, despite the fact that financing costs for the SPE will no longer be capitalized in the financial statements.

The Board will continue to explore opportunities that will benefit both the property development and construction segments. The Group has launched a new property development, project EkoTitiwangsa in February 2025. For the construction segment, the Board expects the ongoing rationalization of the construction scope under the RTS Link project to positively contribute to the Group's future construction revenue and earnings. Additionally, the Group continues to work closely with the Government on various infrastructure projects.

Our subsidiary, PLS Plantations Berhad ("PLS"), is undergoing a transformation from a cyclical oil palm plantation business to a more diversified range of upstream and downstream activities. This transformation will require a longer gestation period, especially for the durian trees, which have a growth period of about 4 to 5 years. As such, the bulk of PLS's durian revenues currently come from trading activities. In the near term, PLS will continue its rehabilitation and sanitation efforts, focusing on recommended plantation practices to improve the production yield of its oil palm estates, mature durian plantation, and contract farms. PLS will also work closely with both existing and potential business partners to increase the retail offtake rate and margin of downstream durian products through offshore wholesalers and end consumers. At the same time, upstream investments in durian plantation will remain a key focus for PLS, complementing its existing downstream business while waiting for the durian farm to mature and produce in the next 3 to 4 years.

This aligns with the Group's long-term strategy to expand and diversify into other sectors, reducing dependency on its existing construction and property development businesses.